Si Hay Sistema - Capital Work in Progress purchases in ERPNext

Assets that take time to build can be accounted for with Projects

·

5 min read

Many times, you have a construction project that takes months before it will be put to use as an asset. In fact, you will have many separate invoices for specific purchases of building materials. To keep track of this in our business, we require appropriate labelling (can be a simple write-in using a pen or a stamp) of any and all purchase invoices whose ultimate purpose is directly linked for our specific construction project.

To keep track of this in ERPNext, I like to use a Capital Expense account, and a Project where we will link all the Invoices mentioned above. The Capital Expense account allows you to save money on sales tax payments (at least as per some administrative regions' accounting and fiscal rules). The Project helps keep track of all those invoices in one place, by centralizing their totals, along with tasks and other necessary documents and sub-projects. Once the asset is ready to come to use, you can specify the value by manually entering the total value of all the Purchase Invoices in the tallied by all the invoices upon asset creation in ERPNext.

Note: I personally use the 2017 IFRS taxonomy for accounting, to which I added child accounts for specific country and personal requirements, and then coded by the following numbers:

1 - Asset accounts

2 - Equity accounts

3 - Liability accounts

4 - Income accounts

5 - Expense accounts

6 - Income Tax Accounts

7 - Non Operating Income and Expense Accounts

As you can see, any capital expenses and capital maintenance expenses I like to track at level 7. This segregates operating (categorized as 5 accounts) from non-operating expenses (categorized as 7 accounts). In this example, I will be expensing any invoices for the construction of a building using accounts at level 7.

Add a Project

Go to Projects > Project

Add a New Project

Name it something significant: "Office building at 24th & 56 street"

Add an end date and a description, along with any other requirements.

Configure your Capital Expense Account

Accounting > Chart of Accounts

Find the account node you wish to use as capital expense. If you have not created it, do so by adding a child account node to the parent for Capital Expense.

Capital Expense is usually abbreviated as: "CAPEX"

For example:

07 - Non Operating Income and Expense > 07.00 - Other Expenses > 07.00.05 - Other Expenses By Nature > 07.00.05.01 - Capital Expense > 07.00.00.05.01.01 - Office building at 24th and 56 street CAPEX

My node account (where entries will be registered against): 07.00.00.05.01.01 - Office building at 24th and 56 street CAPEX

All the other accounts as group accounts, which simply group or tally balances from child accounts.

Itemized Invoices or Individual Item?

Itemized Invoices - intensive data entry

I like to keep my accounting neat, and this includes keeping an itemized tracking of every individual item specified in the invoice. For this I like to use UNSPSC categorization, a relatively complete product and services standardized coding scheme maintained by United Nations and GS1. (GS1 also manages the coding scheme for UPC and EAN product barcodes, search the web for local GS1 offices in your area). The only negative aspect of this is that each item is tallied, therefore extra time must be spent configuring the item accounts, specifications, units of measure, etc. I have trained a group of agents to properly do so, and with a parallel data entry methodology, and by breaking down invoices by period, we can make quick work of up to 1000 invoices in a month, each with 5 to 20 items each. Once the items and invoices exist, we can duplicate them and create similar of the same items, or reuse them in future invoices. All of the items in these Capital Expense invoices must be set to NOT maintain stock. (Maintain Stock = No).

Simplified Generic Individual Item - faster data entry

Some of my customers temporarily faint at the mere thought of entering data in such a granular matter. All they want is an invoice representing the grand total amount, and a single generic "item" on it. For this we create an item named "Office Building Item Expenses" and configure its expense account to the specific expense account we want: "07.00.00.05.01.01 - Office building at 24th and 56 street CAPEX". We use this item in each capital expense invoice, and change the rate of the item such that the invoice equals the amount to be expensed. For auditing transparency, we still add a digital copy of the invoice to the corresponding Purchase Invoice. We also set this item up as an item where stock will not be kept track of. (Maintain Stock = No)

Note: On a day to day basis, users mix the Simplified Generic Individual Item for capex invoices with detailed item tracking for operating purchase invoices

Add Purchase Invoices and link to your Project until Finished

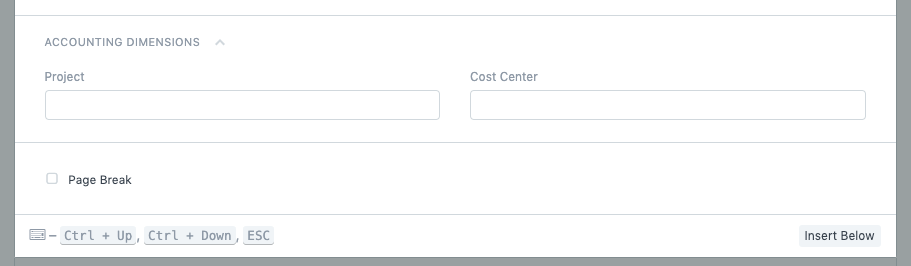

Once you have selected one of two methods: Itemized or Simplified Generic Individual Item, enter each invoice related to your construction project, being careful to select the Project in the accounting dimensions section on each line item. You do this by clicking on the downward arrow to the right of the line item on the Purchase Invoice, and scrolling all the way down to the Accounting Dimensions section.

Caution: If you do not select the Project under the line Item, the grand total amount will not be added to the project. If you missed some invoices, you can always Cancel > Amend > Submit.

Create Asset Category

While the project is ongoing, or when just ready to create the asset, prepare yourself by creating the Asset Category for the Office Building.

The asset category is required to create the asset. It groups the accounts you wish to use for:

- Depreciation expense account

- Fixed asset account

- Accumulated depreciation account

It also allows you to configure depreciation schedule (time perdios, duration, etc.)

Create Asset Item

Now create an Item representing your asset. Make sure Maintain Stock = No and Is Fixed Asset = Yes. Select the asset category you just created. Save the Item.

Create the Asset

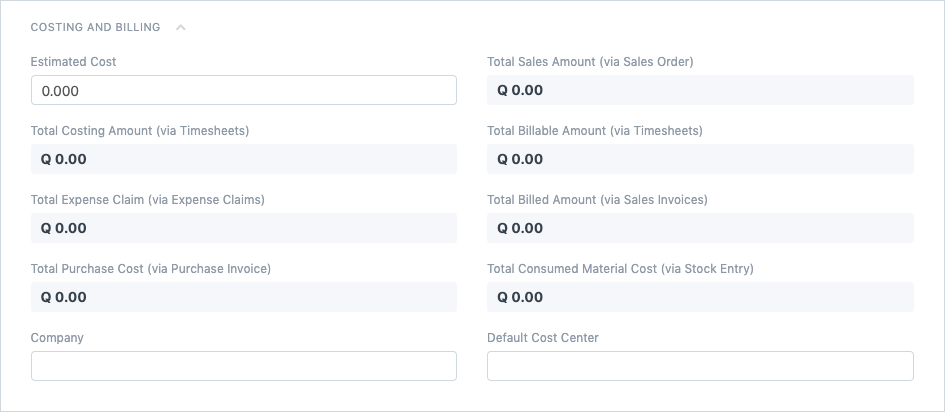

When the project has concluded and you are ready to have the asset "come to use" and begin depreciation, create the asset, selectin the asset item and asset category you just created. Add any descriptions or information you wish. Most importantly, use the Total Purchase Cost (vía Purchase Invoice) from the Project's Costing and Billing section as the asset's opening value. This allows you to create an asset for which you do not have a single purchase invoice.

Save and Submit the asset.

Depreciations will now be automatically booked when required, as configured

Asset Maintenance and Asset Repairs

One of the most useful aspects of ERPNext is that it allows you to keep track of maintenance for each asset, even creating a maintenance activity schedule and a maintenance team responsible for the upkeep of the asset, where logs can be kept for auditing purposes.

You can also log repairs when the asset has problems that require repairs. This helps mitigating situations where repairs are reported as required but not necessary. It also helps with quality verifications (did the repair last long enough as promised?)

Reference:

https://floqast.com/blog/book-fixed-asset-journal-entry/

1 comment

Great Article. This process has got automated via the Asset Capitalization feature.